Founded in 2008, Betterment is an online investment company based in New York. It provides automated, goal-based investing, which is also known as a Robo-advisor. Unlike similar products offered by companies like Personal Capital, Betterment doesn’t require a minimum investment for entry. It also charges fees much lower than most of the competition.

Getting Started With Betterment

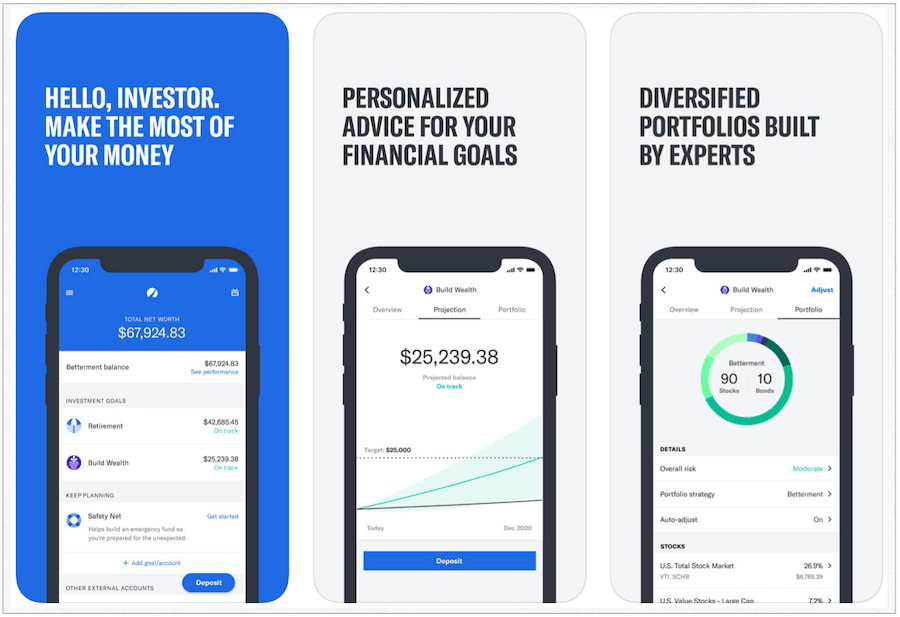

To guide you, Betterment asks you a series of questions to get an idea of what type of investment is good for your situation. It also asks for your age, pretax income, and how much you’ve already saved, if anything. From there, the company suggests a series of goals it can help you to achieve. These may include the creation of a safety net, retirement fund, or general investing. One of the first things you’ll notice about Betterment’s suggestions is that they provide this information for free. In other words, you can take its thorough advice, save or print it, and go somewhere else to invest. Naturally, it hopes you use its guidance and begin investing in-house. For this, you can set up recurring or one-time investments. Ultimately, each suggested plan consists of a combination of stocks and bonds that automatically adjusts based on your current age. The percentage breakdown between the two types of investments automatically changes as you get older.

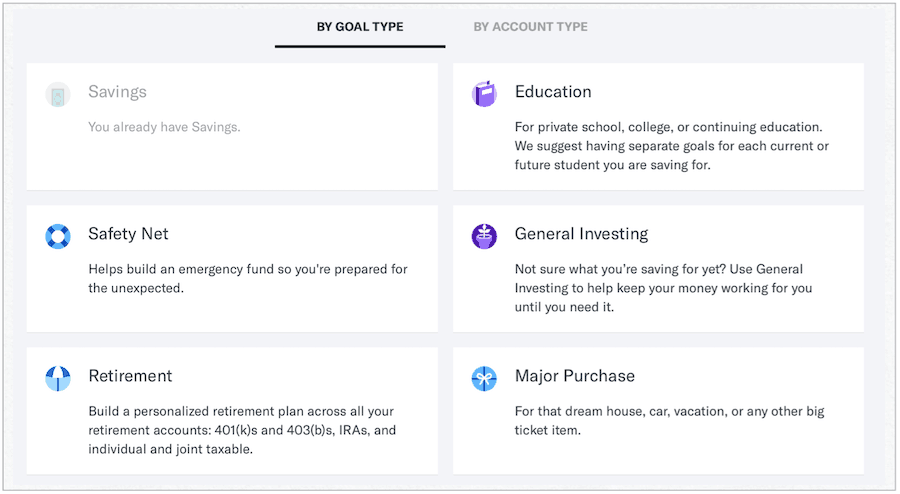

Here’s a brief look at each type of savings or investment plan Betterment offers:

A Safety Net

Betterment considers the creation of a safety net for clients its highest priority goal for most investors. With this as a goal, the company hopes to help you create an investment portfolio that grows faster than inflation but isn’t too risky. The allocation is likely to include stocks, but not as much as other suggested plans. After all, a safety net should be easy to tap in the event of a financial emergency.

Retirement

When formatting a plan for retirement, the earlier you begin, the more flexibility you have. Despite this, even if you’re planning to retire in under a decade, Betterment can offer recommendations. Generally, the younger you are, the more Betterment recommends owning stock vs. bonds. As you get ever closer to retirement age, the percentage between the two slowly moves in favor of bonds.

General Investing

If you have no underlying goal, Betterment suggests simple general investment advice and planning. This goal doesn’t have a specific purpose or withdrawal date baked into the advice. As such, it’s a great way to generate long-term savings and achieve similar goals.

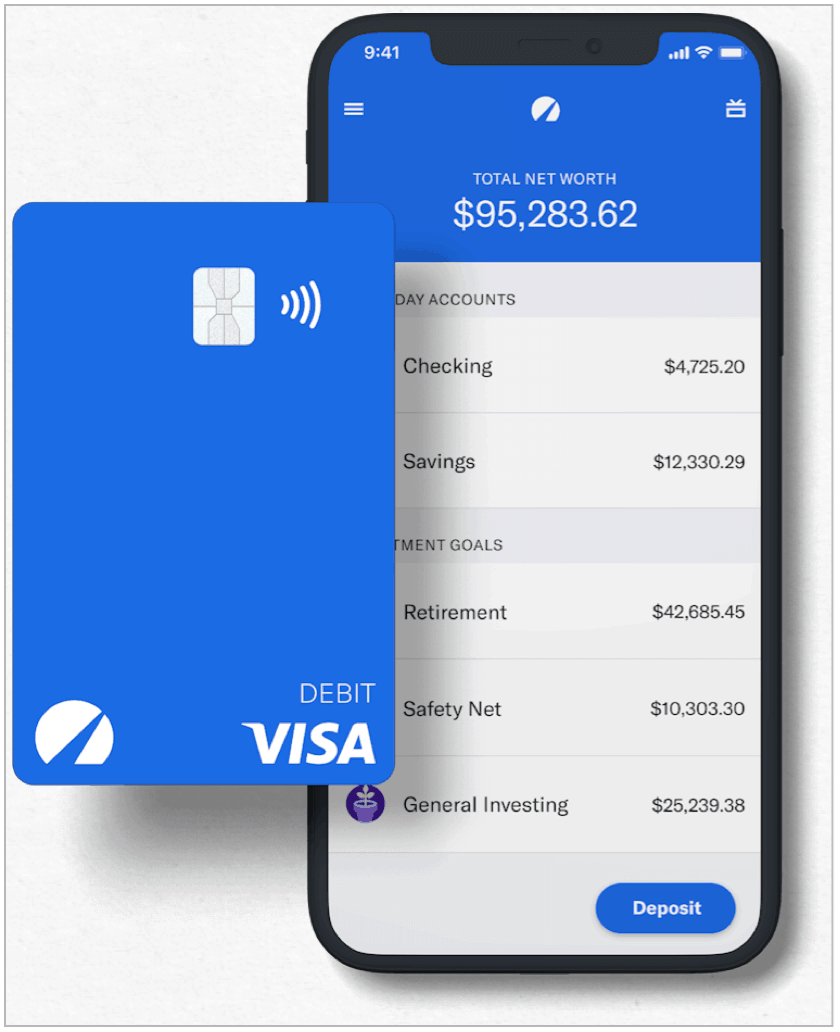

Savings and Checking

If you want to generate a return on your current monies, you might want to consider the Betterment Everyday Savings plan, where you can earn up to 2.39 percent APY with FDIC-insured accounts up to $1 million. Like with Betterment’s other offerings, the savings program does not require a minimum deposit. Betterment is also in the process of offering a checking account program, which will feature ATM reimbursements and no account minimums or monthly maintenance fees. Debit cards arrive for those who sign up for an account.

Education

Whether you’re planning on going back to school or you have kids that are going to college, education planning is also essential. Once again, Betterment offers ways to achieve your goals based on the anticipated costs and period. Have more than one child? You can create separate education goals for each one in your family.

Major Purchase

Finally, there’s Betterment’s major purchase goal. Here, you tell the Robo-advisor what you plan on buying and when. From there, it will suggest a strategy to achieve your target.

Many Choices

Once you select a goal, you’ll need to provide Betterment with personal information such as your address, income, and social security number. If you’re planning to create a retirement account, you’ll need to decide on the type of IRA that’s appropriate for your situation. Betterment explains each type thoroughly online. That’s it! The process of creating a Betterment account is quick, insightful, and, yes, pain-free. Once you establish your Betterment account, you can add more goals at any time. For example, let’s say you’ve decided to open a general investment account but also want to fund a savings account. You can do this with ease.

Moving Forward

Financial goals can change on a dime because of life events and outside forces. For example, you could unexpectedly lose your job, or the stock market could crash. Perhaps one of your children has decided not to start college as initially planned. Or maybe, you’ve decided to work longer than you once anticipated. Regardless of what changes occur, Betterment’s online tools have been designed to adjust for real-time and anticipated changes to any of your plans. In my opinion, this is perhaps the most important reason to give Betterment a try. Your financial situation will always be living, breathing, and yes, changing, and it understands this.

What About Real People?

If you’re one of those folks who hear the word “Robo” and “investing” and get worried, you can relax. Despite using algorithms to make financial recommendations for its clients, Betterment is also backed by real people there to talk to clients. Among the financial advice packages available:

A Getting Started package ($199) gives you phone time with a Certified Financial Planner (CFP). This person will provide a step-by-step tutorial to help you set up your Betterment account so you can maximize all the resources the company can provide.For $299, you can buy a Financial Checkup Package where a CFP can review your current financial situation and investment portfolio.Also, for $299, you can purchase a College Planning Package or Marriage Planning Package.Finally, for $299, you can discuss your Retirement Planning Package with a CFP to get a review of your current situation, accounts and holdings, employer plans, and more.

Costs

Under Betterment’s traditional Digital Plan, you pay an annual fee of 0.25 percent based on your balances the company manages. With a Premium Plan (0.40 percent annually on a minimum balance of $100,000)m you get all the benefits of the Digital Plan plus advice on investments outside of retirement. This plan also features unlimited access to the company’s CFP professionals. You can learn more about Betterment through its website or download the app in Google Play 0r the App Store. Comment Name * Email *

Δ Save my name and email and send me emails as new comments are made to this post.

![]()